Sensational Tips About How To Be A Sole Trader

/hands-holding-book-with-title-sole-proprietorship--696697608-bfa75b69ad094aac9bc1e8c65680ef74.jpg)

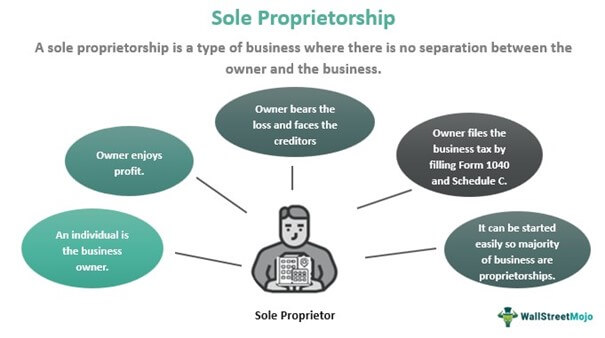

Use your individual tax file number when lodging your income tax return report all your income in your individual tax return, using the section for business items to.

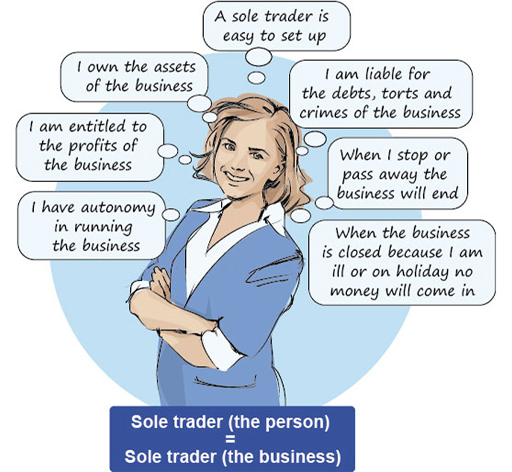

How to be a sole trader. In this video, we show you how to do it.subscribe to smallbusiness and follow. To set up as a sole trader, you need to tell hmrc that you pay tax through self assessment. Registering as a limited company involves additional steps.

A personal ird number for paying income tax and gst government licences and permits that your business needs qualifications or registrations for. To set up as a sole trader, you need to: What is crucial though, is that as well as keeping your personal and business finances.

You don’t want to forget and. To set up as a sole trader, you just need to register online with hmrc. Accounting for non resident landlords;

Everything you earn as a sole trader is essentially your income and that income is subject to tax up to 55%. Being a sole trader allows me to be flexible and more agile. You’ll need to tell them that you pay tax through self assessment, then file a tax return every year.

You need to become a sole trader if: 2) evaluate your expected level of income. If you’re thinking of setting up as a sole trader, there’s a few things you need to do to get started.

Individuals who provide a specialist service like plumbers,. Choose the name you want to trade under , show this. To become a sole trader you must have:

/dotdash_Final_Sole_Proprietorship_May_2020-01-72456bd5ac0d4c868d8f55a2718dbdd2.jpg)

/dotdash_Final_Sole_Proprietorship_May_2020-01-72456bd5ac0d4c868d8f55a2718dbdd2.jpg)