Fantastic Info About How To Check National Insurance Contributions

Every individual making national insurance contributions should ensure their contributions are up to date.

How to check national insurance contributions. You can request a contribution statement by. How do i find out my national insurance number? You may still get a qualifying year if you earn between £123 and £242 a week from one.

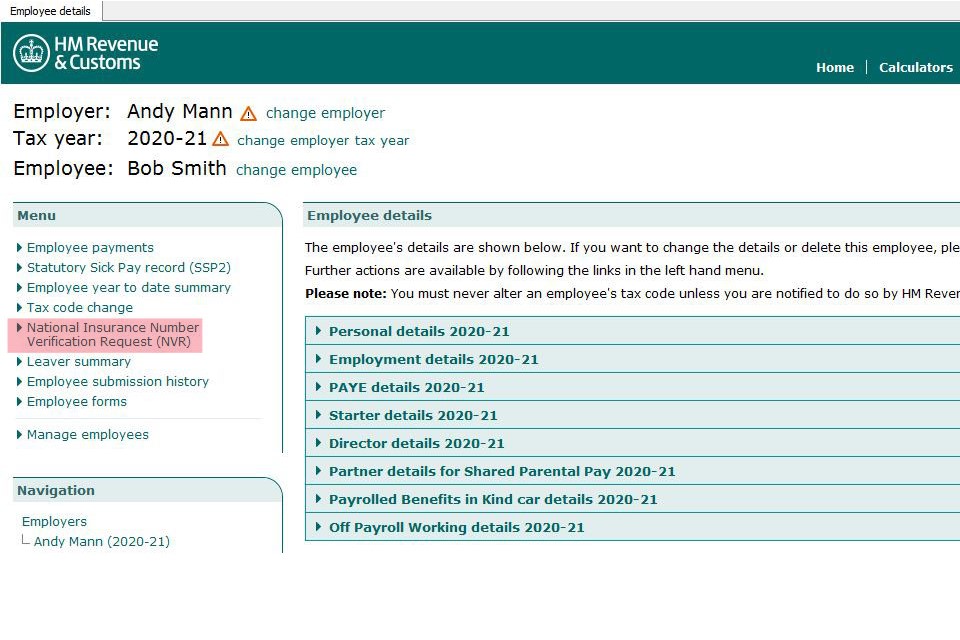

To check your ni contribution record you will need a government gateway account. You pay mandatory national insurance if you are 16 or over and are. Applying for a national insurance statement.

How to check your national insurance contributions record. You can check your national insurance record online to see: Your national insurance number will be on payslips, p60s, and letters concerning tax and benefits.

£242 to £967 a week (£1,048 to £4,189 a month) 13.25%. Registering and logging into your personal tax account to view a letter with it on. On letters about your tax, pension or benefits;

You might not pay national insurance contributions because you’re earning less than £242 a week. You can find your national insurance number: Those earning £242 per week pay class 1 contributions, deducted automatically by your employer.

New business, duplicate) original and photocopy of certificate of incorporation (new business). You will get to the screen below. You will need to sign in using a government.